While many of our families can pay the $30 per night fee, others lack the financial means. Since no one is turned away if they cannot afford it, your tax-deductible contribution is essential. It will help provide the support we need to maintain operations while keeping fees to a minimum for those we serve. The WVU Foundation serves as the fiduciary agent for the Rosenbaum Family House.

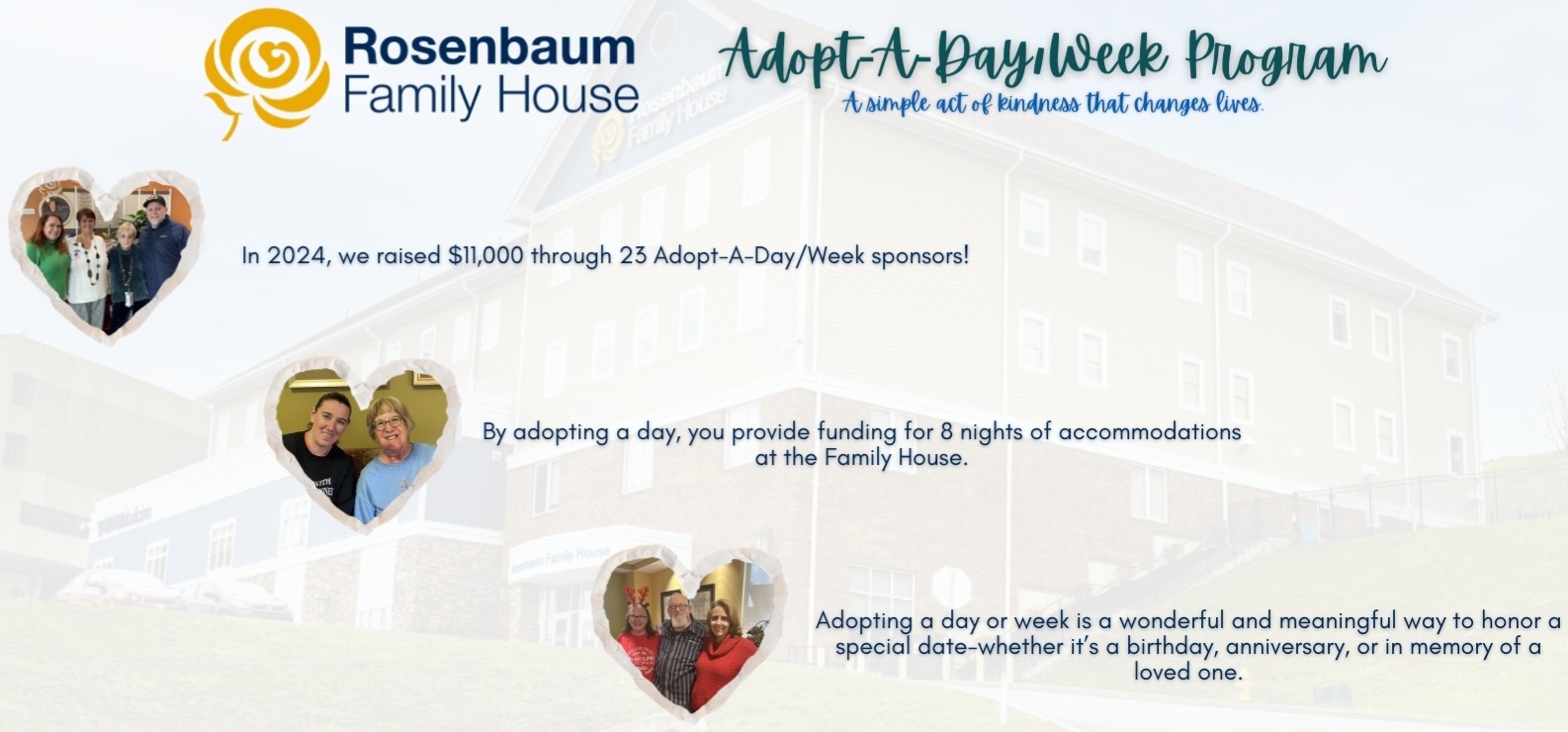

Adopt-A-Day/Week

The Adopt-A-Day/Week Program provides friends, families, and guests the opportunity to support the Rosenbaum Family House by sponsoring a special week or day, such as a memorial date, birthday, anniversary, or other occasion. Funds raised through the Adopt-A-Day/Week program directly support the Rosenbaum Family House Care & Comfort Fund. This fund pays the room balance for families in need when all other means have been exhausted.

The Adopt-A-Day gift of $250 or the Adopt-A-Week gift of $1,000 will sponsor the day/week of your choosing. The message you provide will appear in our newsletter and on our Facebook page. Any day or week may be selected, provided it has not been previously scheduled. If there is a conflict with your preferred date or week, a representative from the Rosenbaum Family House will reach out to you to discuss alternative arrangements.

If you would like to schedule, please contact Joshua Spurbeck at 304 598 6094 or joshua.spurbeck@wvumedicine.org

Tribute Gifts

A tribute gift memorializes or honors a family member or friend while also supporting Rosenbaum Family House. Gifts In Memory Of (IMO) or In Honor Of (IHO) past guests, family, and friends celebrate the relationships individuals have with the Rosenbaum Family House and their community, as they impact the families staying at the Family House every day.

For an IMO gift, include a note with:

-Name of the deceased

-Name of surviving family member(s) to whom notice of this gift is to be given

-Name, address, and amount of each contribution to assure proper recognition

-Contact information for the principal donor, in case there are any questions

For an IHO gift, include a note with:

-Name and address of the person(s) to be honored

Please note: A letter is sent to the honoree with the name and address of the donor(s), but not the amount of the gift

-Name, address, and amount of each contribution to assure proper recognition

-Contact information for the principal donor, in case there are any questions.

Alternative Means of Giving

In-Kind Gifts

Do you have a unique asset, such as a work of art, a book collection, equipment, software, a license, or real estate? You may be able to make a gift-in-kind and transfer ownership of the property to the Rosenbaum Family House.

Securities and Retirement Assets

Donating securities such as stocks, bonds, or mutual funds is a common way to contribute. IRA charitable rollover – If you are at least 70½, you can make a charitable gift directly from your IRA without incurring federal income tax on the withdrawal.

Donor Advised Funds

If you participate in a donor-advised fund, you can easily direct your donation to benefit a specific program.

Matching Gifts

Your employer may offer a gift-matching program that matches your generosity dollar-for-dollar.

Create an Endowment

We can also tailor your individual interests to a specific need by creating an endowment that provides ongoing support. Depending on the purpose, endowments require different minimum gift sizes.

Gifts Through a Will

A bequest is a gift made through your will or estate. It can be for a specific dollar amount or asset, a percentage of the total estate, or the remainder of the estate.

Retirement Fund Assets

You can name the Rosenbaum Family House as a beneficiary of your retirement fund assets.

Life Insurance

You can also name the Rosenbaum Family House as a beneficiary of a life insurance policy. A Charitable Giving Rider attached to the policy will pay out an additional percentage of the face value of the policy at no extra cost to you. You can also use a new or existing policy to fund a future gift to us, or give us a policy whose coverage you no longer need.

A Charitable Gift Annuity is a contract that will pay you or a beneficiary a fixed amount for the rest of your life. If you don’t need your income stream yet, you can set up a deferred gift annuity and set up a future date to begin receiving payments.

A Charitable Remainder Annuity Trust (CRAT) is similar to a gift annuity, as it makes annual payments fixed at a specific percentage of the trust’s value at the time of establishment. It provides a fixed amount for a specified term, such as a set number of years or for life.

A Charitable Remainder Unitrust (CRUT) pays you or other named beneficiary a fixed percentage of the principal in the trust as it is valued annually. Additional gifts can be made to a CRUT at any time.

A Charitable Lead Trust provides an annual payment for a fixed term of years, after which the principal is returned to the individuals whom you designate. This can help reduce your taxable estate and pass your property to your heirs with considerable tax savings.

Retained Life Estates allow you to give their home or other property to the Rosenbaum Family House while retaining the right to live in and use the property while they are alive.

Pay by Credit Card

Click to complete the online secure payment form.

Pay by Check

Make check payable to: Rosenbaum Family House

Mail to:

Rosenbaum Family House

30 Family House Drive

Morgantown, WV 26506